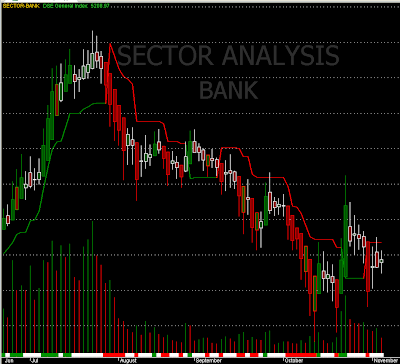

After breaking the resistance, price went to up

When price breaks a Support or Resistance level, we usually call it Breakout. Breakout occurs with high volume and big movement.of price.

Some investors follow Breakout Trading Strategy/Technique i.e. they buy shares when price break the resistance level and sell share when price break the support level. Please check some previous chart and I hope you will find that several successful trend started after a breakout. A portion of my capital, I invest according to the Breakout Trading Strategy/Technique.

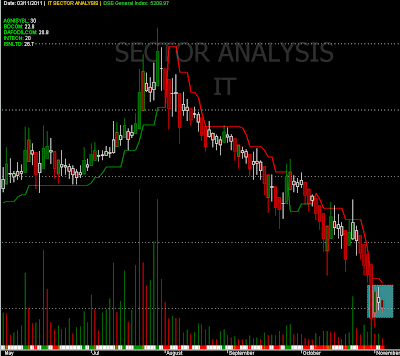

No trading system/technique is 100% accurate. So, you may sometimes caught by breakout, usually we call it - "Fakeout". Please see the below Chart -2 :

After breaking the resistance, price went to down